alphaAI's Friday Finance Fix | Fri. Sept. 22nd, 2023

Welcome to our Friday Finance Fix Newsletter, where we bring you the latest updates on key financial developments shaping the economy and markets.

Fed's Rate Hike Uncertainty Casts Shadows on Market Sentiment

The recent weak market performance is strongly due to the Federal Reserve reports, which indicated at least one more rate hike will happen. Thursday, September 21st, the Fed articulated that interest rates would stay the same for the time being, with the potential for another hike. The news put investors and the market into a negative sentiment, adversely reflecting on the stock market. If the negative sentiment regarding inflation and rate hikes continues, a downward slide can be expected.

Impending Government Shutdown Threatens Economic Stability

The White House signaled a potential government shutdown due to the House failing to reach a funding agreement. Kevin McCarthy needs to get enough votes by October 1st for the new spending bill, or federal programs will no longer have any funding. As the House Republicans battle over the funding bill that includes aid for Ukraine, a government shutdown could damage the economy further. Depending on the longevity of the shutdown, billions could be lost on a weekly basis, further hurting the economy.

September's Iconic IPO Wave Sparks Hope and Excitement in Tech Sector

September may be the month of iconic IPOs (initial public offering). With several significant IPOs hitting the market, Arm Holdings, Klaviyo, and InstaCart, the debuts are assisting market sentiment. Regardless of the downturns following an initial IPO (which is typical), the companies released created excitement in the technology sector and provided hope for similar opportunities. IPOs typically indicate new companies, new jobs, new growth, and potential for new gains.

Global Inflation Fuels Soaring Oil Prices and Economic Uncertainty

Inflation isn’t just in the US, it’s impacting oil prices. As global inflation surges, so do oil prices, with 1 barrel costing nearly $100 this past month. The price change is due to demand from China, cuts from Russia and Saudi Arabia, and the climbing travel rates. If demand for oil keeps rising and supply becomes more limited, fear will keep inflating like the prices. The growth in the economy could be stunted because of reduced consumer spending in volatile times.

Elon Musk's Tesla Thrives Amidst UAW Strikes and Auto Industry Turmoil

Despite the UAW striking against the three major car automakers, Elon Musk is benefiting in the wake. The downturn for GM, Ford, and Stellantis is due to contracts being up the UAW (United Auto Workers), but Musk is appreciating his non-unionized workforce at Tesla (TSLA). As electric vehicles continue solidifying and growing in the auto market, Musk is taking advantage of his rivals' weaknesses and benefiting in the dire scenario. Tesla is dominating the market, taking advantage of its edge, experiencing growth surges, and, not surprisingly, receiving higher application rates.

Stay informed with our Friday Finance Fix Newsletters. Explore the impact of Fed rate hikes, looming government shutdown risks, the excitement surrounding iconic IPOs, global inflation's effect on oil prices, and how Elon Musk's Tesla is thriving amidst industry turmoil. Get the latest updates on key financial developments shaping the economy and markets.

What about alphaAI?

In any investment endeavor, the key to success lies in making informed decisions. Whether you're building a recession-resistant portfolio, diversifying your assets, or simply exploring new opportunities, your journey should be guided by knowledge and insight. At alphaAI, we are dedicated to helping you invest intelligently with AI-powered strategies. Our robo advisor adapts to market shifts, offering dynamic wealth management tailored to your risk level and portfolio preferences. We're your trusted partner in the complex world of finance, working with you to make smarter investments and pursue your financial goals with confidence. Your journey to financial success begins here, with alphaAI by your side.

Supercharge your trading strategy with alphaAI.

Discover the power of AI-driven trading algorithms and take your investments to the next level.

Explore Our Journal

Stay updated with our latest blog posts.

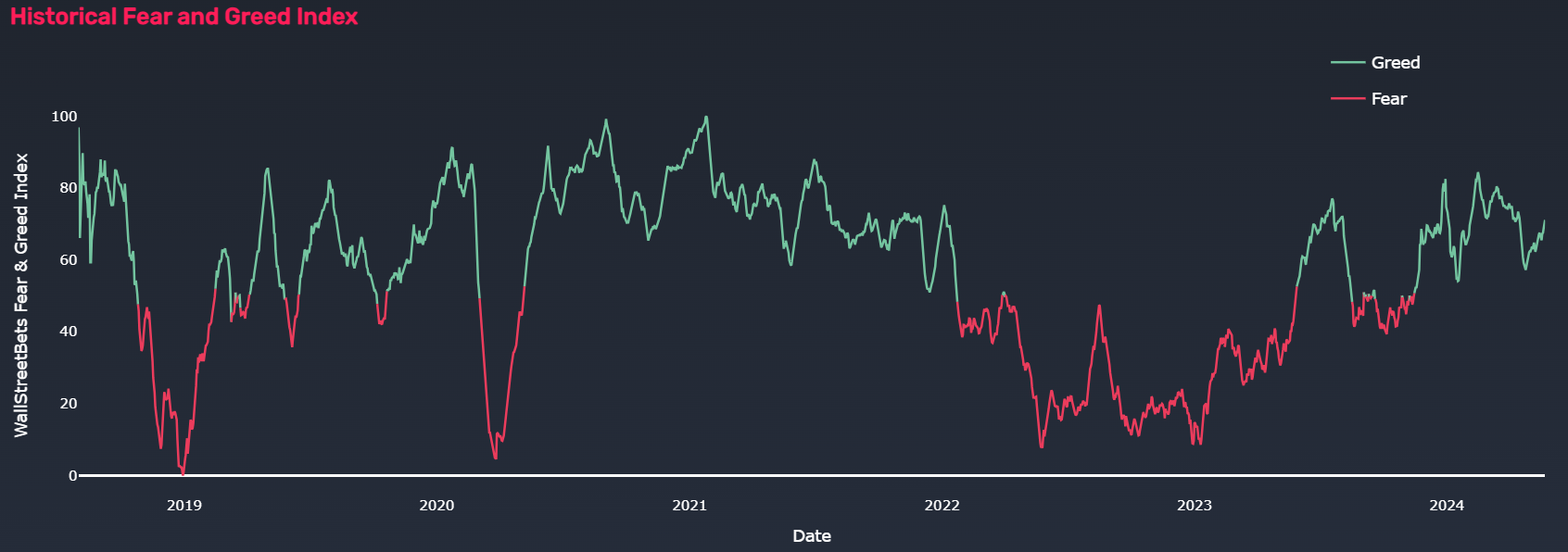

Using Quiver Quantitative’s Fear and Greed Index to Manage Leveraged ETF Volatility For More Successful Investment Outcomes

Santa Claus Rally: Stock Market's Holiday Surge