alphaAI's Friday Finance Fix | Friday, Nov. 17th, 2023

Welcome to our Friday Finance Fix Newsletter, where we bring you the latest updates on key financial developments shaping the economy and markets.

Fed Speakers Continue Inflation Talks

As December begins, the financial world is abuzz with updates from key figures within the Federal Reserve. On Thursday (November), Fed speakers Williams, Daly, and US Treasury Secretary Yellen collectively conveyed a message: Inflation may be cooling, but the path ahead is not entirely clear. The consensus suggests progress towards the 2% inflation target while maintaining a robust labor market. Notably, Goolsbee reinforced this stance, highlighting the strides made in combating inflation.

Federal Chair Jerome Powell's December statement further added to the narrative. Powell affirmed the Fed's readiness to tighten policies if deemed appropriate while emphasizing the continued strength of the labor market. Despite this unsurprising analysis, the market responded positively, with all three major indexes moving into the green. Investors are buoyed by the progress made in taming inflation, but caution remains as uncertainties persist.

UAW Plans to Expand

In the realm of labor relations, the United Auto Workers (UAW) is embarking on an ambitious campaign to expand its reach. Building on the success of a recent strike against the Detroit Three manufacturers, UAW President Shawn Fain aims to organize 13 non-unionized automakers. The goal is to extend negotiations beyond the Big Three, targeting nearly 150,000 workers across companies like BMW, Honda, Tesla, and Toyota.

The union faces challenges, especially in traditionally non-unionized Southern plants. However, recent historic contracts and increased support provide momentum. Organizers are collecting union authorization cards online, emphasizing issues like corporate profits and executive compensation. As the UAW ventures into uncharted territory, tough battles lie ahead.

OPEC+ Meeting Agrees to Cut Voluntary Oil Output

A pivotal OPEC+ meeting unfolded with an agreement to cut oil production by 2.2 million barrels per day from the next year. Concerns about a potential oil surplus in 2024 and lower prices prompted the move aimed at supporting prices and stabilizing the market. However, the market responded negatively to the news, as the cuts were not as deep as anticipated.

Despite the disappointment, the meeting marked a notable decision, and OPEC+ extended an invitation to Brazil to join its ranks. The market will closely watch how these production cuts impact prices and manufacturing in the coming months.

Musk Cybertruck Release Slightly Disappointing

Tesla's much-anticipated Cybertruck has finally hit the roads, but the launch was not without its challenges. Production delays and unexpected costs have made the Cybertruck more expensive than initially promised. Elon Musk insists that these difficulties are par for the course with new technology, but concerns about profitability linger.

On launch day, only 10 Cybertrucks were delivered, and it's projected to take 18 months before it significantly contributes to Tesla's cash flow. Success hinges on attracting traditional pickup truck buyers, but profitability remains a significant hurdle. Despite the setbacks, if Tesla can overcome these challenges, it could pave the way for the company to reclaim a $1 trillion valuation.

Big Execs Backing Nikki Haley

In the political arena, several prominent business leaders, including JPMorgan CEO Jamie Dimon, are throwing their support behind former South Carolina Governor Nikki Haley in the Republican presidential primary. Despite endorsements from figures like Charles Koch, Haley faces an uphill battle against the dominance of Donald Trump, who leads in fundraising.

GOP megadonors are drawn to Haley for her perceived rational policies, but she trails significantly in head-to-head matchups against Trump. While polling shows her as the second-most-popular GOP candidate in New Hampshire, closing the gap against Trump's popularity remains uncertain. The shifting landscape of endorsements and support could significantly impact the economic outlook as the elections unfold.

What about alphaAI?

In any investment endeavor, the key to success lies in making informed decisions. Whether you're building a recession-resistant portfolio, diversifying your assets, or simply exploring new opportunities, your journey should be guided by data and time-tested methodologies. At alphaAI, we are dedicated to helping you invest intelligently with AI-powered strategies. Our roboadvisor automatically adapts to market shifts, offering dynamic wealth management tailored to your risk level and portfolio preferences. We're your trusted partner in the complex world of finance, working with you to make smarter investments and pursue your financial goals with confidence. Your journey to financial success begins here, with alphaAI by your side.

Supercharge your trading strategy with alphaAI.

Discover the power of AI-driven trading algorithms and take your investments to the next level.

Explore Our Journal

Stay updated with our latest blog posts.

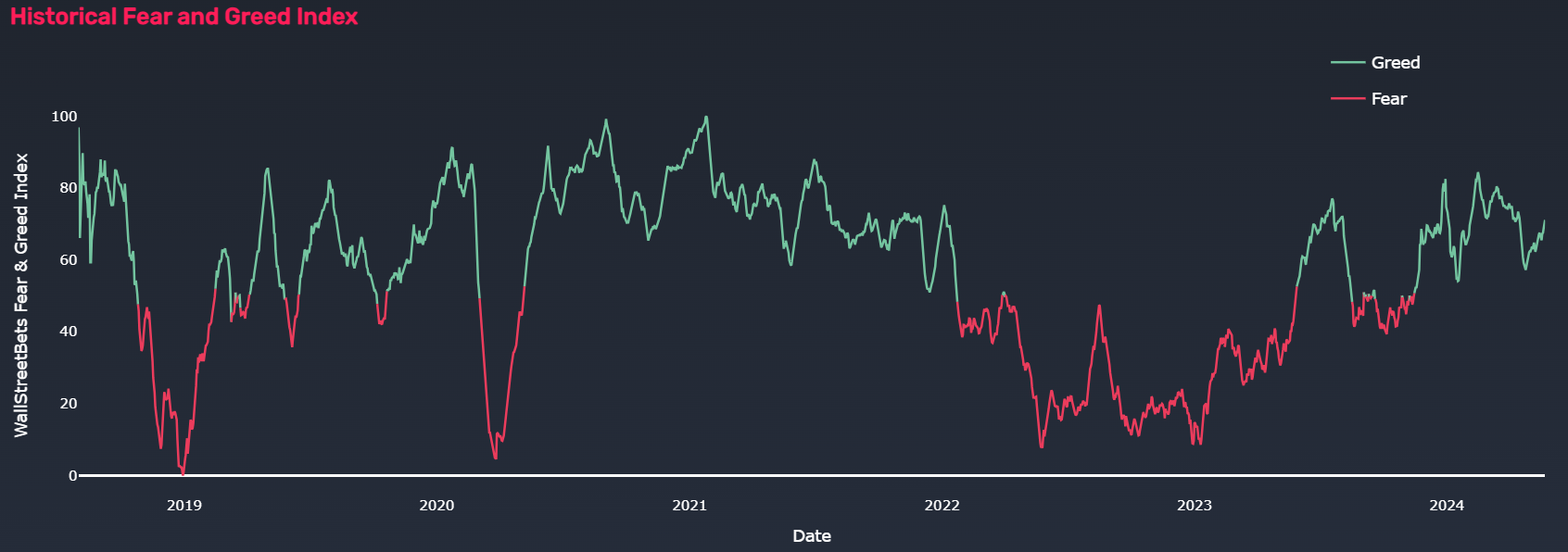

Using Quiver Quantitative’s Fear and Greed Index to Manage Leveraged ETF Volatility For More Successful Investment Outcomes

Santa Claus Rally: Stock Market's Holiday Surge