alphaAI's Friday Finance Fix | Friday, Oct. 27th, 2023

Welcome to our Friday Finance Fix Newsletter, where we bring you the latest updates on key financial developments shaping the economy and markets.

Tech Sector Takes a Hit

The tech industry experienced a significant downswing last week, with the market closing at its lowest point since May. The earnings season brought its fair share of drama, particularly for the tech giants. While Alphabet managed to beat analysts' expectations, it couldn't offset the underperformance of Google's cloud business. This led to a 9.5% drop in Alphabet's stock, sending the entire technology sector into a selling frenzy. Even positive reports from Meta, Microsoft, and Amazon couldn't lift the market. In the background, the bond market remained rocky, with the 10-year Treasury note surpassing 5%, which could have far-reaching implications for the economy.

The sources: CNBC, The New York Times

Twitter's (Sorry, X) Troubles Continue

Twitter, now under the ownership of Elon Musk, has been facing a series of challenges. Global app downloads have plummeted by 38%, monthly active users have dropped by 14.8%, and users are spending 2% less time on the platform. In the United States, ad revenue has declined by a staggering 60%. These setbacks are attributed to various factors, including advertiser pullouts, technical glitches, user issues, and increasing incidents of hate speech. As Twitter struggles, users are actively exploring alternatives, although none have emerged as a strong contender yet.

The sources: Axios, Morning Brew

U.S. Consumers Keep Spending

Despite looming threats of a potential recession, high housing and rental costs, and nationwide strikes, U.S. consumers continue to spend. The U.S. GDP grew by 4.9% in the last quarter, largely fueled by robust consumer spending. Factors contributing to this strength include strong wage growth, easing inflation, and an improving job market. Consumers appear undeterred by global crises as they seek experiences like dining out, travel, and entertainment. However, the return of student loan payments in the next quarter could introduce some uncertainty.

The source: Morning Brew

Ford Strikes a Deal with UAW

After over six weeks of pressure and targeted strikes, the United Auto Workers (UAW) finally reached a tentative deal with Ford. The deal outlines a 25% hourly wage increase over the life of the four-plus-year contract, resulting in a top hourly wage of over $40. This marks a significant victory for auto workers, as wages have rarely risen more than 3% in a year. With one contract on the table, the UAW strikes continue, now targeting the most profitable factories of other major automakers, including Stellantis and GM.

The source: Morning Brew

EV Production Slows Amidst Car Payment Struggles

Americans are increasingly supportive of green energy, but many are struggling to keep up with auto loan payments. Low-income Americans are falling behind on their auto loans, and repossession rates are expected to rise substantially this year. Analysts suggest that UAW strikes, coupled with consumers' financial difficulties, have led to a slowdown in electric vehicle (EV) production by companies like Ford and GM. However, as strikes conclude and the Biden administration continues to promote green energy solutions, the EV market could see a positive shift.

The sources: Morning Brew, Read The Joe

What about alphaAI?

In any investment endeavor, the key to success lies in making informed decisions. Whether you're building a recession-resistant portfolio, diversifying your assets, or simply exploring new opportunities, your journey should be guided by knowledge and insight. At alphaAI, we are dedicated to helping you invest intelligently with AI-powered strategies. Our roboadvisor adapts to market shifts, offering dynamic wealth management tailored to your risk level and portfolio preferences. We're your trusted partner in the complex world of finance, working with you to make smarter investments and pursue your financial goals with confidence. Your journey to financial success begins here, with alphaAI by your side.

Supercharge your trading strategy with alphaAI.

Discover the power of AI-driven trading algorithms and take your investments to the next level.

Explore Our Journal

Stay updated with our latest blog posts.

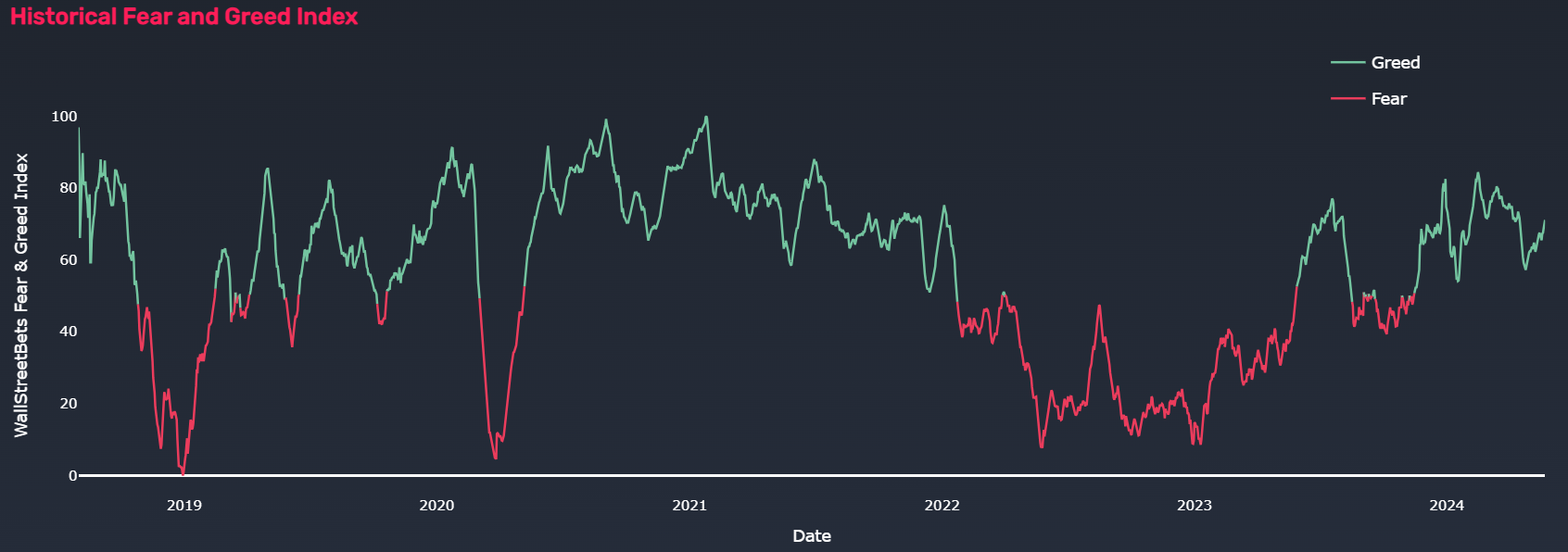

Using Quiver Quantitative’s Fear and Greed Index to Manage Leveraged ETF Volatility For More Successful Investment Outcomes

Santa Claus Rally: Stock Market's Holiday Surge