alphaAI's Friday Finance Fix | Friday, Oct. 6th, 2023

Welcome to our Friday Finance Fix Newsletter, where we bring you the latest updates on key financial developments shaping the economy and markets.

The Market’s Recent Volatile Behavior Is Partly Due to Treasury Yield Highs

The Treasury yield hit 4.8% on Tuesday, October 3rd, its highest in 16 years. The market’s recent low numbers this past week are a reaction to the intensity of what that information could mean. If numbers like that continue, the housing market would freeze, and the country would officially roll out a recession. However, lucky for the economy, the Treasury yield started to cool off after a three-day losing streak once more information came out concerning the job market. That crisis isn’t on the table for now, but if severe interest hikes continue, it could cause ongoing volatility.

Job Reports Blow Market’s Mind!

In positive news, the job market is surging, with September reports showing 336,000 jobs being added, on top of the 170,000 in August, according to Bloomberg. Although this could indicate another rate hike from the Fed, it only indicates that the market is strong and can handle it. With layoffs low, payroll nearly matching, and an unchanged unemployment rate, it is no wonder Jamie Dimon is thinking upward for the future of the work week. In the midst of September being a wild card in the year 2023, the CEO of JP Morgan asserts there could be a 3.5-day workweek for the next generation because of AI. Developments need to ramp up intensely, but with the unexpected turns in the job market, don’t bet against it.

Strike Updates and Other Developments

To complement the favorable job market reports, 85,000 Kaiser Permanente healthcare workers went on a three-day strike that supposedly ends today. However, there is no agreement in view. Although Kaiser Permanente agreed to raise wages, it wasn’t enough and didn’t address staff shortages. If the strike continues into the weekend, it could inspire other frustrated healthcare workers to partake in a record-breaking industry stand. While the healthcare workers continue negotiating, the UAW strike continues with “really active” talks and bargaining. Ford has sucked it up and is narrowing down negotiation terms with the union, meaning the strike could end for the major auto company soon. However, Stellantis and GM haven’t been as responsive, with General Motors obtaining a new line of credit in response to the impact but not budging in negotiations. If Ford breaks through to the union while GM and Stellantis struggle, it could see a dominating effect in the market once employees fill in their spots.

Consumer Spending Could Indicate Economic Weaknesses

Although jobs are remaining strong, consumer spending isn’t! Goods and services were down $58.3 billion in August compared to $64.7 billion in July, and some analysts are making calls that the US is at the beginning of a recession. Why is consumer spending down? For a few reasons, student loan payments began again while inflation increased, COVID-savings are mostly gone, market sentiment, gas prices, the housing market, strikes, fair wages, and overall news reporting; after all that, consumers are trying to save money. It’s almost as if the media and news bombarding people with fears of a recession causes people to start acting like the US is in a recession. The companies heavily impacted by the trend include Coca-Cola, Walmart, Target, Apple, Best Buy, and more. Maybe that’s why Tim Cook, CEO of Apple, started dropping stock this past week.

Government Shutdown on Hold, But Just Wait to Be “Thankful.”

Surprise, surprise, the government shutdown was averted at the last minute, but not without Kevin McCarthy being voted out as Speaker of the House. Apparently, the Republican leader’s work with the Democrats to avoid the government shutdown sparked outrage enough to cause his party to turn on him. Does this mean the shutdown won’t happen? Unfortunately, it’s even more likely to happen now than before, just near Thanksgiving this time. Why is it more likely to happen? The same Republicans who voted out McCarthy from his position are now demanding extreme cuts to spending bills regarding the White House and the Senate (both currently being run by Democrats). Basically, what they’re asking is impossible, and if they don’t concede, a shutdown will happen. The economic impact still stands, but it’s a waiting game for when it could happen. Despite the ongoing talk of a recession, the immediate indicators have been averted.

What about alphaAI?

In any investment endeavor, the key to success lies in making informed decisions. Whether you're building a recession-resistant portfolio, diversifying your assets, or simply exploring new opportunities, your journey should be guided by knowledge and insight. At alphaAI, we are dedicated to helping you invest intelligently with AI-powered strategies. Our roboadvisor adapts to market shifts, offering dynamic wealth management tailored to your risk level and portfolio preferences. We're your trusted partner in the complex world of finance, working with you to make smarter investments and pursue your financial goals with confidence. Your journey to financial success begins here, with alphaAI by your side.

Supercharge your trading strategy with alphaAI.

Discover the power of AI-driven trading algorithms and take your investments to the next level.

Explore Our Journal

Stay updated with our latest blog posts.

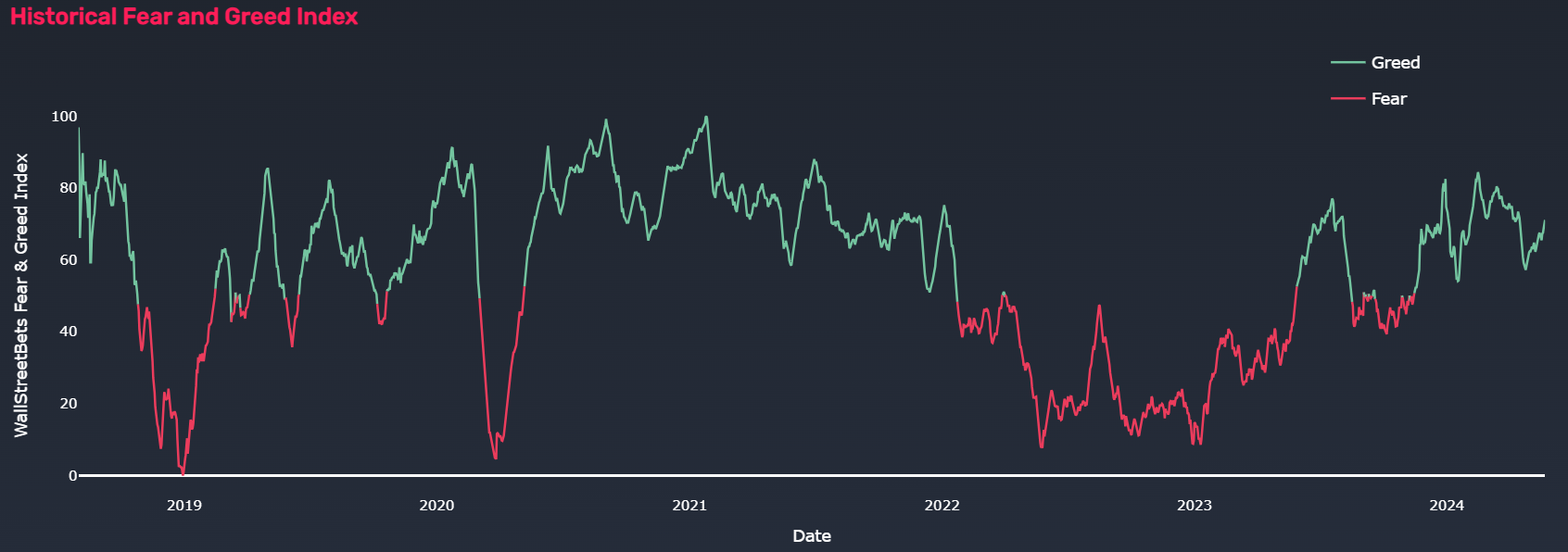

Using Quiver Quantitative’s Fear and Greed Index to Manage Leveraged ETF Volatility For More Successful Investment Outcomes

Santa Claus Rally: Stock Market's Holiday Surge