Solar Power’s Impact on America’s Energy Market

The events that kick the US into high gear are usually centered around competition, which is exactly why solar manufacturing will be the next boom in the stock market. With China’s dominance of the market, Biden’s incentives in the Inflation Reduction Act, and the potential economic gains, it sets the US market up for a new source of energy.

Why is solar-based power being pushed?

Energy has been the battle of the globe since the beginning of time, it just takes different forms along the way. Currently, the energy market is evaluated as an $8 trillion dollar industry, with solar taking up 1% of it. However, those numbers are shifting, with countries like Japan and Germany relying fully on solar energy for decades.

Despite the US contributing the majority of the original research behind solar energy, China is the largest producer of solar panels in the world. According to Energy Sage, “China manufactures 75% of modules, 85% of cells, 97% of wafers, and 79% of polysilicon,” essentially controlling over 80% of solar panel production, completely dominating the market.

In comparison, the US is currently manufacturing just over 2% of the world’s solar panels, which isn’t sitting well with the US. With the recent push in global EV, volatility over energy sources (e.g., oil), fear over China’s solar panel production, and the potential for savings, the US’s 2% is on its way to quickly change.

The US is now pushing for solar panel manufacturing within the US. If you’ve noticed how green energy has recently been pushed by the Biden administration, the reason is to ultimately combat China’s dominance of this growing market.

What is the US encouraging?

Biden passed the Inflation Reduction Act (IRA) in 2022, which created generous incentives for companies to manufacture solar PV components in the United States.

The Inflation Reduction Act of 2022 introduced substantial incentives like the Advanced Manufacturing Production Tax Credit (45X MPTC), to encourage domestic production of clean energy components. This tax credit directly benefits companies involved in manufacturing photovoltaic cells, PV wafers, PV inverters, battery storage modules, and critical minerals essential for clean power generation.

In addition to the tax credit, the Department of Energy has been authorized to provide loans of up to $400 billion to support the growth and operation of emerging solar companies.

What Does That Mean for the US?

In the coming years, a boom in solar manufacturing. Frank Van Mierlo, CEO of a solar PV manufacturer, stated, “The energy market is $8 trillion and solar is 1% of it today. There will be solar companies with $100 billion market capitalizations in the near future.” This statement boasts of a hopeful future for the US’s ability to fill in the previous gaps of green energy.

How can you capitalize on it?

How can investors capitalize on the future boom of solar panel manufacturing? First, do your research on companies already established and that are up and coming because of Biden’s incentives. Next, consider ETFs that track the solar energy industry, evaluate publicly traded solar companies (ex. First Solar, Enphase Energy, and SunPower), and look into privately owned solar companies moving towards IPOs because of growth.

Regardless of potential, it is also important to remember that solar energy is a cyclical industry, as is the energy sector. Meaning that there will be periods of time when the industry is growing rapidly and other times when it is growing more slowly. Be prepared for this volatility and have a long-term investment horizon, but also consider what the bright future of the US with such a push towards solar panel manufacturing.

What about alphaAI?

In any investment endeavor, the key to success lies in making informed decisions. Whether you're building a recession-resistant portfolio, diversifying your assets, or simply exploring new opportunities, your journey should be guided by knowledge and insight. At alphaAI, we are dedicated to helping you invest intelligently with AI-powered strategies. Our robo advisor adapts to market shifts, offering dynamic wealth management tailored to your risk level and portfolio preferences. We're your trusted partner in the complex world of finance, working with you to make smarter investments and pursue your financial goals with confidence. Your journey to financial success begins here, with alphaAI by your side.

Supercharge your trading strategy with alphaAI.

Discover the power of AI-driven trading algorithms and take your investments to the next level.

Explore Our Journal

Stay updated with our latest blog posts.

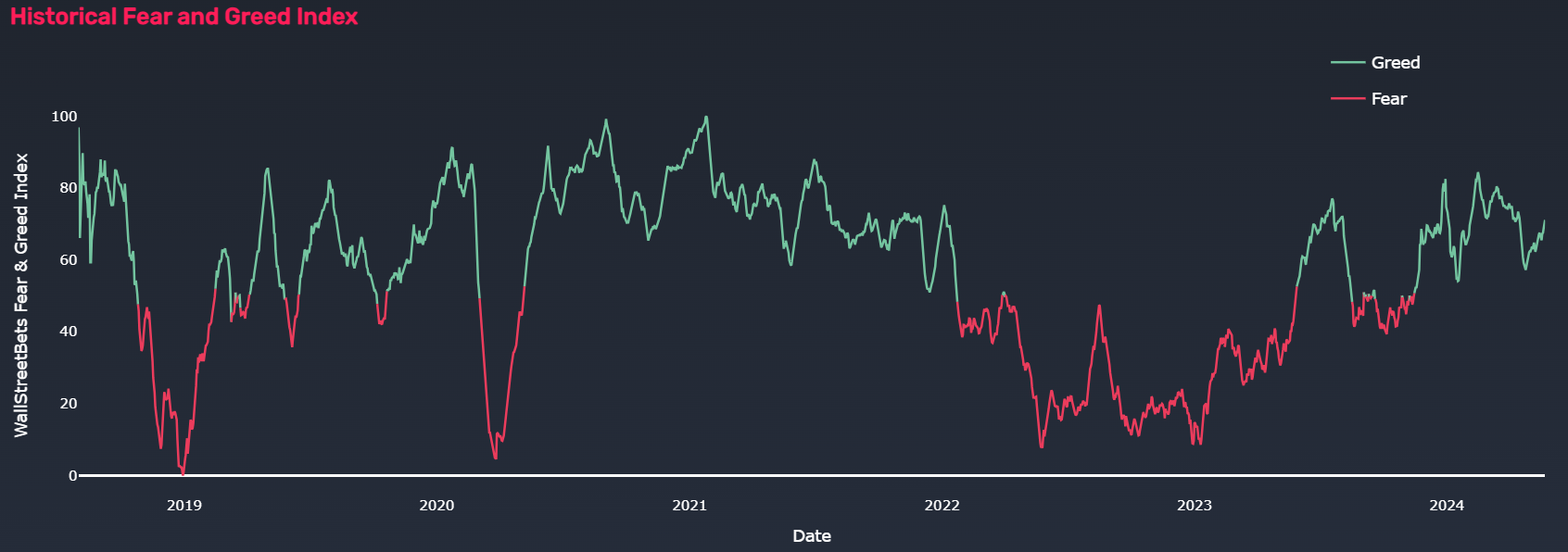

Using Quiver Quantitative’s Fear and Greed Index to Manage Leveraged ETF Volatility For More Successful Investment Outcomes

Santa Claus Rally: Stock Market's Holiday Surge