Tesla's Profits Take a Hit as It Slashes Prices

Tesla, the pioneer of electric vehicles (EVs), has long been a trailblazer in the automotive industry. Known for its innovation, groundbreaking technology, and sleek electric cars, Tesla has been leading the charge in making electric mobility accessible to the masses. However, its recent aggressive price cuts have raised eyebrows, as they come at a significant cost to the company's bottom line. In this blog post, we'll explore the consequences of Tesla's price-cutting strategy, its impact on the company's profitability, and the challenges it faces in an increasingly competitive EV market.

Price Cuts Boost Demand

Tesla's strategy of slashing prices has undeniably had a positive impact on demand for its electric vehicles. Lower prices have made Tesla cars more affordable and accessible to a wider range of consumers. This approach has led to a surge in vehicle deliveries, resulting in a notable increase in revenue compared to the previous year. More people are now able to experience the thrill of driving a Tesla, and the company's electric cars have become more attainable to a broader audience.

Profit Plummets by 44%

However, the downside of this price-cutting strategy became evident when Tesla reported a significant 44% decline in third-quarter profit. While it's true that revenue has increased, the company's profit margins have taken a hit due to the aggressive price cuts. This stark decrease in profitability highlights the challenges Tesla faces as it balances affordability with sustainability.

EV Market Slows Down

Another factor contributing to Tesla's profit slump is the slowing pace of electric vehicle adoption. The once-exponential growth in the EV market has slowed, and Tesla is now facing increased competition from traditional automakers like Ford and General Motors (GM), both of which have made significant strides in the electric vehicle space. As these legacy automakers enter the EV arena, they are providing customers with more alternatives, intensifying the competition for market share.

Aging Models and the Cybertruck

In addition to increased competition, Tesla's most popular models are aging. The Model 3, Model S, and Model X, while still popular, are facing pressure from newer and more technologically advanced models from other automakers. This further underscores the need for Tesla to innovate and update its lineup to remain competitive.

One of the much-anticipated Tesla vehicles is the Cybertruck, which has experienced multiple delays. Tesla has now announced that it will begin delivering the Cybertruck in November. While it has generated significant buzz, some skeptics question its mass-market appeal. The Cybertruck's unique design and capabilities might not cater to a broad consumer base, potentially limiting its impact on the market.

The Takeaways

Tesla's decision to lower prices to stimulate demand has certainly achieved its goal by increasing vehicle deliveries and revenue. However, it has come at a significant cost, as the company's profit margins have taken a substantial hit. Furthermore, with the growth of the electric vehicle market slowing and increased competition from traditional automakers, Tesla's future is not without its challenges.

As Tesla moves forward, it will need to balance affordability with profitability, update its aging models, and innovate to stay ahead of the competition. The success of the long-awaited Cybertruck remains to be seen, but Tesla's ability to adapt and evolve will ultimately determine its position in the ever-evolving electric vehicle landscape.

What about alphaAI?

In any investment endeavor, the key to success lies in making informed decisions. Whether you're building a recession-resistant portfolio, diversifying your assets, or simply exploring new opportunities, your journey should be guided by knowledge and insight. At alphaAI, we are dedicated to helping you invest intelligently with AI-powered strategies. Our roboadvisor adapts to market shifts, offering dynamic wealth management tailored to your risk level and portfolio preferences. We're your trusted partner in the complex world of finance, working with you to make smarter investments and pursue your financial goals with confidence. Your journey to financial success begins here, with alphaAI by your side.

Supercharge your trading strategy with alphaAI.

Discover the power of AI-driven trading algorithms and take your investments to the next level.

Explore Our Journal

Stay updated with our latest blog posts.

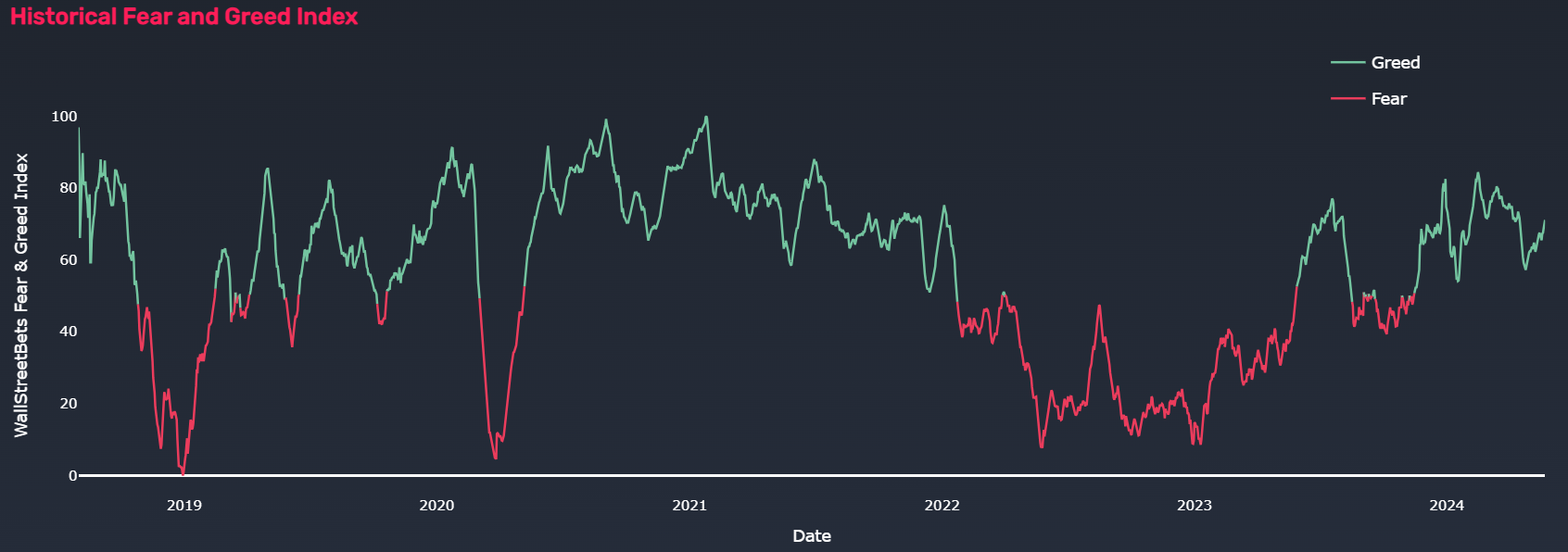

Using Quiver Quantitative’s Fear and Greed Index to Manage Leveraged ETF Volatility For More Successful Investment Outcomes

Santa Claus Rally: Stock Market's Holiday Surge