Dive deeper into the world of investing and applied AI.

Stay up to date with our expert articles on AI and investment.

Introduction

The stock market doesn’t exist in a vacuum; it is shaped by a wide array of factors, including political actions and legislative decisions. Among the more intriguing trends in recent years is the influence of Congressional trading patterns on the ETF market. With public disclosure of Congress stock trades required under the STOCK Act, investors are gaining insights into how lawmakers—often dubbed “politician traders”—position themselves in the market.

One of the most notable examples of this influence comes from Nancy Pelosi trades, which have attracted significant attention for their focus on high-growth technology stocks. This article explores how Congressional trading impacts ETF markets, highlighting the connections between political moves, sector performance, and leveraged ETF strategies.

Understanding Congressional Trading and the STOCK Act

The STOCK Act, passed in 2012, mandates that lawmakers disclose their trades within 45 days, creating a unique window into Congress stock trades. These disclosures have led to a wave of interest in politician trading, with retail investors tracking these activities to identify potentially lucrative trends. Platforms like Unusual Whales aggregate data on Congressional trading, enabling users to observe how political actions may correlate with market performance.

While the STOCK Act’s primary goal was transparency, it inadvertently created an investment strategy: using Congress stock trades as a signal for market moves. This has significantly influenced ETF markets, where sector-specific ETFs—particularly those focused on technology—align with patterns observed in politician trading.

The Role of Congress Stock Trades in Sector Performance

One of the most striking examples of the relationship between Congressional trading and market performance lies in Nancy Pelosi trades. Pelosi’s investments, often focused on tech heavyweights like Nvidia, Apple, and Microsoft, have highlighted the impact of political confidence in certain sectors. These trades frequently coincide with legislative developments or economic initiatives that favor tech growth.

For example, Pelosi’s Nvidia investment in 2021 came as demand for semiconductors surged, driven by advancements in AI and data processing. Such trades not only spotlight key industries but also influence sector-specific ETFs, as investors aim to align their portfolios with similar growth trajectories. The ripple effect of Congressional trading often drives attention to ETFs that focus on these politically endorsed sectors.

How Politician Trading Shapes ETF Markets

The influence of Congress stock trades extends beyond individual stocks, shaping broader market behavior and ETF trends. Here’s how:

- Sector-Specific ETFs: Congressional trading often signals confidence in specific industries, such as technology, healthcare, or energy. This boosts demand for sector-specific ETFs that track these industries, as investors seek to capitalize on the same trends observed in politician trading.

- Market Momentum: When prominent lawmakers, such as Nancy Pelosi, disclose high-profile trades, it can create a wave of investor activity. This momentum not only affects individual stocks but also drives volume in ETFs linked to those sectors.

- Leveraged ETFs: For sophisticated investors, Congress stock trades serve as a roadmap for identifying opportunities in leveraged ETFs. These products allow investors to amplify exposure to sectors like technology, which often align with politician trading trends, while maintaining flexibility to pivot when market conditions shift.

- Regulatory Uncertainty: Legislative actions and political sentiment can introduce volatility, especially in sectors heavily influenced by policy changes. This volatility makes hedged and risk-managed ETFs particularly appealing to investors navigating markets shaped by Congressional trading patterns.

Nancy Pelosi Trades and Their ETF Implications

Among Congressional trading patterns, Pelosi’s portfolio stands out for its heavy weighting in technology stocks. This has led to increased interest in ETFs that align with her trades, particularly those focused on the “Magnificent 7” (tech giants driving market performance). ETFs tracking tech or semiconductor industries often see heightened activity following disclosures of Pelosi’s trades.

However, Nancy Pelosi trades also highlight the challenges of mirroring politician trading patterns. The disclosure lag means that by the time these trades are public, much of the market opportunity may have already passed. This creates a need for more responsive investment strategies that can quickly adapt to evolving market conditions.

A Smarter Way to Leverage Congressional Trading Insights

While Congress stock trades and politician trading patterns provide fascinating insights, the real challenge for investors lies in making these insights actionable. Disclosures often come too late to replicate exact trades, and the inherent risks of concentrated sector exposure make blindly following politicians a flawed strategy. This is where alphaAI’s technology provides a better alternative.

Instead of mirroring Nancy Pelosi trades or relying on static strategies, alphaAI uses industry-leading AI to analyze market trends—including those influenced by Congressional trading. Here’s how alphaAI turns political trading patterns into smarter investments:

- Dynamic Portfolio Adjustments: alphaAI’s AI system tracks millions of data points daily, ensuring your portfolio adjusts dynamically in response to market conditions and trends—like those stemming from Congress stock trades.

- Risk Management: Our technology doesn’t just chase returns; it actively manages risk by adapting to changing market environments. Whether the markets are booming or in decline, alphaAI works to protect your capital while capturing opportunities.

- Long-Term Focus: Unlike short-term strategies tied to political moves, alphaAI ensures that your portfolio is built for sustainable growth across varying market conditions. By analyzing macro trends and sector performance, alphaAI helps you avoid the pitfalls of reactive investing.

Conclusion: Transforming Political Insights into Smarter Investments with alphaAI

While the rise of Congress stock trades and politician trading has reshaped how investors think about market opportunities, the limitations of these strategies are clear. Late disclosures, unpredictable motivations, and the risks of sector concentration mean that simply copying Nancy Pelosi trades or following other Congressional portfolios isn’t a sustainable path to success.

alphaAI takes the valuable insights from Congressional trading and transforms them into actionable, risk-managed strategies. By combining political trends with advanced AI-driven analysis, alphaAI empowers investors to capitalize on market opportunities without the downsides of blind imitation.

Ready to invest smarter? Let alphaAI help you turn insights from Congress stock trades into a portfolio that’s dynamic, responsive, and built for growth. Explore alphaAI today and experience the next evolution of investing.

In recent years, the stock market’s gains have been driven largely by a select group of powerhouse companies known as the "Magnificent 7." This elite group—comprising Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla—not only dominates their respective industries but also represents a substantial portion of the S&P 500’s weight. Their performance has become a significant force behind market returns, often making up the bulk of gains in the broader index. Here, we’ll explore how these companies achieved their dominance, why they play such an influential role in stock indices, and how alphaAI offers a unique approach to access their growth potential through the FNGU leveraged ETF—while using automated risk management to guard against volatility.

Why the Magnificent 7 Have Outsized Influence in the S&P 500

The S&P 500, one of the most widely-followed benchmarks for U.S. stock performance, is a “market-cap-weighted” index. In a market-cap-weighted index, each company’s influence is determined by its market capitalization (the total value of its shares). Larger companies have more sway over the index, meaning that changes in their stock prices can dramatically affect the overall performance of the S&P 500.

For instance, if a company with a $3 trillion market cap like Apple sees a 2% increase, it will have a larger impact on the S&P 500 than a company with a $500 billion market cap experiencing the same percentage gain. This weighting mechanism makes the index highly sensitive to the performance of its largest constituents, particularly the Magnificent 7, whose combined weight accounts for over 30% of the S&P 500’s total.

To put this concentration into perspective, if the S&P 500 were equal-weighted—meaning each company contributed equally to the index—returns would look much different. Historically, the S&P 500 Equal Weight index has underperformed the standard S&P 500 because it doesn’t benefit as heavily from the gains of these top companies. Here’s a comparison of returns over various periods, illustrating the impact of market-cap weighting:

This difference showcases the power of the Magnificent 7. In recent years, these companies have consistently driven higher returns for the S&P 500, leading to impressive gains in a concentrated manner that might otherwise not be possible with a broader base.

How the Magnificent 7 Became Market Titans

The Magnificent 7 companies have achieved remarkable growth by leading innovation in their industries and maintaining competitive advantages that fuel their long-term value creation. Here’s a closer look at some of the stocks that have contributed to the S&P 500’s success:

- Apple (AAPL): With a decade-long return exceeding 1,000%, Apple has transformed from a hardware maker into a global leader in technology and services, continuously outperforming the broader market.

- Microsoft (MSFT): Known for its evolution from software to cloud computing, Microsoft has expanded its value, generating 11x returns over the past decade.

- Nvidia (NVDA): A frontrunner in AI and graphics processing, Nvidia’s explosive growth has brought returns of nearly 12,950% since joining the S&P 500 in 2001.

- Tesla (TSLA): Revolutionizing the automotive industry with electric vehicles, Tesla’s stock has skyrocketed by over 800% since 2020 alone.

Each of these companies has not only contributed significantly to the tech industry but has also enhanced overall S&P 500 performance by adding enormous value.

Leveraging the Magnificent 7 with FNGU and alphaAI

Investing in the Magnificent 7 individually can be a costly endeavor, given their high share prices. However, leveraged ETFs offer an efficient way to gain exposure to this group. alphaAI’s portfolios leverage the FNGU ETF, which tracks the performance of the Magnificent 7 with the added benefit of three times the daily returns. In other words, FNGU offers leveraged exposure, amplifying the gains (and potential losses) of these tech giants on a daily basis.

FNGU is an appealing option for investors looking to capitalize on the rapid growth potential of the Magnificent 7 without the need for direct, individual stock purchases. However, while leverage can magnify gains, it also increases exposure to market volatility, making it crucial to have an intelligent risk management strategy in place.

How alphaAI’s Dynamic Risk Management Maximizes Gains and Mitigates Risks

alphaAI’s platform combines FNGU’s leverage with a powerful, AI-driven risk management system that actively monitors and adjusts portfolios to capture gains while minimizing potential losses. Here’s how alphaAI manages this delicate balance:

- Dynamic Portfolio Adjustments: alphaAI’s platform isn’t a static robo-advisor. It continuously monitors hundreds of data points across the market, adapting portfolios in real time. In bullish markets, alphaAI may take an aggressive stance, maximizing the leveraged returns of FNGU, while in volatile markets, it moves to a conservative or hedged state to protect investor capital.

- Automated Risk Management: Unlike traditional robo-advisors, which may only provide automated portfolio construction, alphaAI actively manages risk. Our AI-driven system detects market changes quickly, rebalancing portfolios to reduce exposure during downturns and taking advantage of favorable conditions for growth. This proactive approach helps alphaAI harness the Magnificent 7’s upside while buffering against market corrections.

- Adaptive Portfolio States: alphaAI’s portfolios have four distinct states—surge, steady, cautious, and defense—designed to respond to market dynamics. During market rallies, alphaAI can adopt an aggressive position to maximize growth through FNGU. In uncertain markets, the platform shifts to a more conservative approach to protect assets, giving investors the benefit of growth-oriented exposure without excessive downside risk.

Why alphaAI is the Smarter, More Responsive Way to Invest

For investors aiming to capture the growth potential of the Magnificent 7, alphaAI offers a powerful solution that combines the high growth of FNGU with disciplined, AI-driven risk management. By leveraging exposure to the market’s top-performing companies and employing a dynamic risk approach, alphaAI provides a unique opportunity to benefit from these tech giants without needing to monitor and adjust positions constantly.

alphaAI’s model allows retail investors to experience the advantages of institutional-grade portfolio management. Unlike static robo-advisors, alphaAI adapts to changing market conditions, actively managing portfolios for optimal performance. This means investors can participate in the Magnificent 7’s growth story with confidence, knowing alphaAI’s AI-driven system is there to protect their capital.

Introduction

Congress may not be the most popular institution among Americans, but for certain investors, it can be a source of profitable investment insights. Through the rise of the politician stock tracker industry, investors can now access tools that follow Congress stock trades, with Nancy Pelosi's trades garnering particular interest. Platforms tracking the trades of high-profile lawmakers have grown in popularity, driven by the belief that these politicians hold an informational advantage in the market.

Thanks to the STOCK Act, Congressional members must disclose their stock transactions within 45 days, giving the public a view of Congress stock trades, albeit delayed. Despite this lag, the allure of mimicking trades by politicians—especially those of Nancy Pelosi—continues to grow. However, our studies have shown that copytrading politicians tends to underperform the S&P 500 due primarily to timing issues. In this article, we’ll dive into the pros and cons of politician stock trackers and introduce alphaAI’s data-driven alternative to simplistic copytrading.

The Rise of the Politician Stock Tracker Industry

The STOCK Act, a law aimed at curbing conflicts of interest, requires politicians to disclose their trades, inadvertently sparking the politician stock tracker industry. With platforms like Unusual Whales and Quiver Quantitative, investors can follow the moves of lawmakers who are sometimes seen as “insiders.” These tools offer users insight into Congress stock trades across various sectors, popularizing the idea that tracking these trades might provide a market edge.

Some financial firms have even created ETFs based on Congress stock trades. For example, the NANC ETF mimics Democratic lawmakers’ trades, with Nancy Pelosi’s trades often highlighted due to her reputation for tech-heavy picks. With Pelosi’s involvement in major stocks like Nvidia, Apple, and Amazon, she has become a focal point for investors who want to emulate her portfolio choices.

The Allure and Risks of Congress Stock Trades

High-profile figures like Nancy Pelosi, whose trades are heavily covered by politician stock trackers, appear to have an edge. One notable example is her 2021 investment in Nvidia, which saw massive gains as the AI industry and tech sector boomed. Nancy Pelosi trades like these often focus on high-growth tech companies, contributing to her reputation for strong returns.

However, copytrading Congress stock trades come with built-in risks. Here’s why copying them may not be as beneficial as it seems:

- Disclosure Lag: By the time Congress stock trades are disclosed (up to 45 days after execution), the market has often moved. This lag can make it challenging to capture the same returns, making many politician stock trackers less effective.

- Unpredictability: Lawmakers’ trading motives can vary widely. Many trades by members of Congress are made with unique personal or political motives that may not align with regular market trends.

- Lack of Comprehensive Risk Management: While politician stock trackers might help investors spot trends, they often lack risk management tools, leading to significant losses if markets turn volatile.

Nancy Pelosi Trades and the Copytrading Phenomenon

Pelosi’s trades—particularly in technology stocks—have spurred increased interest in politician stock trackers and specific funds modeled after her trades. Her Nvidia purchase in 2021, for example, sparked a wave of similar trades among retail investors who saw tech’s potential for exponential growth. While it’s true that Congress stock trades can deliver impressive gains, these results are typically not repeatable due to market timing and disclosure lags. According to Quiver Quantitative, a Nancy Pelosi copytrading strategy has actually underperformed the S&P 500 since 2019. In our analysis, we found the primary reason for this underperformance to be due to data lag. Pelosi typically discloses her trades 45 days after they’re made, and by that time, the market has already moved significantly. Copytrade investors bear the brunt of the pain as they miss out on gains or are too late to exit a position.

If copytrading is not a viable investment strategy, the question arises: How can investors use data from politician stock trades to their advantage? Well, what many investors fail to realize is that Pelosi’s stellar stock market performance is not necessarily due to her prowess as an investor or even her supposed access to insider information, but rather her exposure to the “Magnificent 7” (top-performing tech giants). As of the time of writing, 99% of Pelosi’s portfolio is concentrated in high-flying tech stocks like Apple, Amazon, Google, Salesforce, Nvidia, Netflix, and Crowdstrike. These stocks comprise a significant portion of the S&P 500 and Nasdaq-100 and have driven most of the gains in the stock market over the past several years. Savvy investors realize that rather than risk data lag from copytrading Nancy Pelosi, they can get the same industry exposure by investing in broad market ETFs that track the Nasdaq-100 and Magnificent 7.

alphaAI’s Smarter Approach to Politician Stock Tracker Insights

At alphaAI, we recognize the appeal of politician stock trackers and understand the intrigue surrounding Nancy Pelosi’s and other Congress stock trades. However, rather than simply mirroring these trades, we’ve developed a data-driven strategy that leverages the insights from Congressional portfolios while addressing their key limitations.

At alphaAI, we extrapolated Nancy Pelosi’s trades into a portfolio of leveraged ETFs with the equivalent sector, industry, and Magnificent 7 exposure. We then enhanced it through several layers of automated, AI-driven adjustments:

- Leverage: Our system uses leveraged ETFs to amplify exposure to high-performing sectors like tech, allowing for greater gains while maintaining flexibility across market conditions. This setup lets investors benefit from sector trends without being wholly dependent on individual stocks.

- Automated Risk Management: Our Investment AI adjusts user portfolios based on market dynamics, shifting between conservative and aggressive stances to protect investors from volatility—a crucial feature missing from the standard politician stock tracker products.

- Hedging: Unlike basic politician stock trackers, alphaAI incorporates hedging to guard against market downturns, ensuring that investor capital is preserved during uncertain times.

- Investor Control and Customization: alphaAI allows users to adjust risk settings, so you’re not just following a politician’s portfolio passively but actively managing your investments with industry-leading tools.

Conclusion: Going Beyond Politician Stock Trackers with alphaAI

While tools that track Congress stock trades and Nancy Pelosi’s trades offer insight into high-profile portfolios, they lack the sophisticated risk management and adaptability that true investors need. alphaAI takes the best of what politician stock trackers reveal and combines it with AI technology, creating a more robust investment option that’s dynamic, protected, and intelligent.

If you’re ready to go beyond the basics of a politician stock tracker and invest with a strategy that’s designed to adapt and grow, alphaAI is here for you. Our approach isn’t just about following trends—it’s about making smart, informed investments that can withstand market changes. Start your journey with alphaAI today and see how AI-driven portfolio management can redefine your investing experience.

As Election Day approaches, investors are on edge, uncertain how the election results will affect the markets. Polls show a narrow split across swing states, with many traders preparing for potential delays and disputes over the results. However, while short-term volatility is all but guaranteed, historical data shows that over the long term, who wins the White House has a limited impact on market performance. Here’s why investors should keep their focus on the bigger picture.

Navigating Short-Term Volatility: What to Expect Post-Election

With polls revealing a split electorate and the VIX (volatility index) remaining above 20—a level that signals market jitters—Wall Street is preparing for potential market turbulence. Treasury yields are down, and the dollar has recently seen its largest drop since August. Options markets are showing a defensive stance, indicating that many investors are bracing for the possibility of prolonged uncertainty. If the election results are delayed or disputed, markets could see heightened volatility in the weeks to come.

Compounding the election's immediate effects, the Federal Reserve’s interest rate decision and subsequent press conference are scheduled for Thursday, just days after Election Day. The Fed’s insights on future interest rates will influence markets, as will earnings reports from major companies. Chris Larkin from E*Trade describes this as “not just any week,” highlighting how the timing of multiple economic events could amplify the market’s reaction to the election outcome.

Yet, while the potential for sharp movements exists in the short term, these election-related disruptions often fade. Bespoke Investment Group data shows that the S&P 500 has typically gained 3.9% on average by the end of election years, with positive returns recorded in six out of the last eight elections. As history suggests, while Election Day may bring volatility, the market usually finds its footing.

Long-Term Perspective: Why the Election Won’t Change the Big Picture

Despite the current buzz around election outcomes, long-term investors have little reason to worry. Historical data tells a reassuring story: presidential terms generally don’t dictate the overall trajectory of the market. Over the past decades, markets have shown resilience regardless of which party holds the White House. Deutsche Bank’s analysis revealed that 13 of the last 15 presidents saw average annual stock returns ranging from 10% to 17%, regardless of party affiliation. Such results underscore the fact that market performance is shaped more by economic fundamentals than by politics.

The stock market’s resilience is rooted in underlying drivers like GDP growth, corporate earnings, and inflation—all factors that aren’t closely tied to political cycles. Megan Horneman, Chief Investment Officer at Verdence Capital Advisors, aptly put it: “Market performance has more to do with economic fundamentals and the earnings outlook than it does with who sits in the White House.” This view is echoed by trends over the last eight presidential elections, where the S&P 500 averaged a 6.6% gain in the six months following Election Day, compared to just 1.5% in the six months leading up to it. These numbers illustrate a fundamental truth: the market tends to stabilize and grow over time, regardless of the administration.

Staying Focused on Long-Term Goals: alphaAI’s Approach

For investors wondering how to navigate these turbulent times, focusing on long-term goals remains the best approach. Here at alphaAI, our adaptive portfolios are designed to take advantage of market fundamentals rather than react to short-term political shifts. Here’s how we suggest staying steady in the days and weeks to come:

- Ignore the Noise: Short-term volatility is common around election cycles, but historical patterns show that both Democratic and Republican administrations have overseen strong stock returns. A steady approach rooted in broader economic trends generally outperforms reactive strategies.

- Hedge Against Uncertainty: Rather than making short-term bets tied to political outcomes, alphaAI’s adaptive portfolios focus on hedging against downside risk. By automatically adjusting allocations based on market conditions, our technology helps protect against significant losses and provides a foundation for steady growth, regardless of political cycles.

- Remove Emotion from Investing: Election seasons often heighten emotions, but reacting to daily news can lead to impulsive decisions that derail long-term goals. alphaAI’s AI-driven platform removes emotion from the equation, using data-driven analysis to make calculated adjustments in response to real market shifts rather than momentary headlines.

Final Thoughts: Staying Steady Through Election Cycles

For long-term investors, election seasons bring moments of uncertainty, but the bigger picture remains clear: economic fundamentals drive market growth, not election results. At alphaAI, our technology-driven approach is rooted in this principle, offering clients an investment strategy that stays focused on fundamentals, no matter what happens on Election Day.

Election years can feel turbulent, but by keeping your focus on a solid, data-driven strategy, you can navigate the noise and achieve your long-term financial goals. Presidents may come and go, but well-built investment plans stand the test of time.

Using Quiver Quantitative’s Fear and Greed Index to Manage Leveraged ETF Volatility For More Successful Investment Outcomes

A Study by alphaAI

Richard Sun

May 22, 2024

Intro to Leveraged ETFs

Leveraged exchange-traded funds (ETFs) have long been in the portfolios of risk-tolerant investors seeking magnified gains. Leveraged ETFs typically use financial derivatives and debt to amplify the returns of an underlying index. While a traditional ETF seeks to track its underlying index on a 1:1 basis, a leveraged ETF may aim to track at a 2:1 or 3:1 ratio 1. This means that if the underlying index returns 1% over some period of time, the corresponding 3:1 leveraged ETF will return roughly 3% over the same period of time. Some variances will occur, and leveraged ETFs are also subject to volatility drag 2, but these are topics that will be covered in a separate study.

For the remainder of this study, the leveraged ETF we will specifically refer to is TQQQ. TQQQ is the ProShares UltraPro QQQ ETF and seeks daily investment results, before fees and expenses, that correspond to three times the daily performance of the Nasdaq-100 Index 3. TQQQ is one of the most popular leveraged ETFs on the market, with assets under management (AUM) in excess of $22 billion and an average one-month trading volume in excess of $60 million 4. Since the ETF’s inception in 2010, it has returned an average of 42.7% annually. In the last year alone, TQQQ returned 121.3%, compared with its underlying index, the Nasdaq-100, which returned 39.6% in the same time period (data as of 3/31/24) 5.

Source: Yahoo Finance

Volatility as a Measure of Risk

The primary challenge with TQQQ, and leveraged ETFs in general, is their extremely high volatility. This volatility, in turn, can lead to amplified losses. Since TQQQ aims to track the Nasdaq-100 at a 3:1 ratio, both gains and losses are magnified by roughly three times, with losses often being more pronounced due to volatility drag.

To quantify this problem, we will use volatility, a statistical measure of the dispersion of returns for a given security, fund, or investment strategy 6. Volatility is often measured as the annualized standard deviation of returns of the security in question, which is, in this case, TQQQ. You calculate volatility by finding the standard deviation of the returns and then adjusting it by the square root of the time horizon. For example, if you had the daily returns of an ETF in Excel, you would first calculate the standard deviation of those returns with the STDEV function. Next, you would multiply the result by sqrt(252) to get the ETF’s annualized volatility. We use 252 because there are 252 trading days in a year 7.

The Nasdaq-100 has an average annual volatility of roughly 28% (calculated based on daily returns since December 1998). In a normal distribution, 68% of the data falls within one standard deviation of the mean, and 95% of the data falls within two standard deviations of the mean. Although security returns are not necessarily normally distributed (a topic for a different study), this is the framework we will use to interpret volatility. So if you invested $1,000 in the Nasdaq-100, a volatility of 28% means that there is a 68% chance your portfolio value after one year will be within $720 and $1,280 and a 95% chance it will be within $440 and $1,560. The bottom line is that higher volatility is associated with a higher potential for gain but also a higher potential for loss. For reference, the S&P 500, the most widely used benchmark for the market, has an average annual volatility of roughly 17% (calculated based on daily returns since January 1990). Investors with a lower risk tolerance typically target portfolio volatility below 17%, while those with a higher risk tolerance typically seek volatility in excess of 17%. The best-performing investment strategies aim to deliver returns above the level of volatility taken on. One way of quantifying risk-adjusted return is through the Sharpe Ratio, which we will take a look at later on 8. Another metric we will discuss later is alpha, or an investment strategy’s ability to beat its benchmark 9.

The Problem with Leveraged ETFs

We have already established that the most significant problem with TQQQ is its high volatility. Since its inception, TQQQ has had an average annual volatility of roughly 61%. This means there is a 68% chance you could see returns between -61% and +61% in any given year. With higher volatility comes higher drawdowns, too. For example, in 2022, TQQQ lost nearly 80%. In an exceptionally bad year, TQQQ investors could stand to lose nearly 100% of their investment due to magnified losses combined with the daily rebalancing mechanics of leveraged ETFs and volatility drag.

Source: Yahoo Finance

This level of risk is simply not feasible for investors, nor is it recommended by alphaAI under any circumstance. So, the question remains: How can investors effectively take advantage of the magnified return characteristics of leveraged ETFs while controlling volatility and drawdowns? In the next section, we will introduce alphaAI’s approach to volatility management.

How alphaAI Approaches Volatility Management

At alphaAI, our automated investment strategies are based primarily on exposure management. Exposure is defined as the percentage of your portfolio you have invested at any given time. For example, an exposure of 50% would indicate that 50% of your portfolio is invested and 50% is held in cash. Exposure management is an extremely effective way to manage volatility since the less exposed an investor is, the lower that investor’s volatility will be. The idea behind exposure management is simple: We want more exposure when market conditions are favorable and less exposure when conditions are weak. However, the execution is the most difficult aspect.

We solved this problem by developing proprietary signals that we use to manage exposure. If you are unfamiliar with our AI system and the machine-learning (ML) techniques we used to build it, I recommend checking out our technology overview and our two-part series on ML for stock trading. At a high level, our AI system consists of multiple predictive models that are trained on multiple decades of data for over 10,000 global stocks. On average, each model is trained on more than 10 billion data points. Each model is trained to perform a unique predictive capability, and multiple models work together to make trading decisions 10. Our models work together to generate signals that quantify the level of risk in the market, and we use those signals to manage exposure in an automated and systematic way. Our system will be discussed in more depth in future studies.

As time passes, the market continues to generate data and correlations that have never been present before. This is why it’s impossible for a single signal to be effective 100% of the time. Thus, we recommend that our clients diversify their portfolios by running investment strategies based on multiple different signals. The probability of successful and consistent investment outcomes greatly increases when multiple signals are used together, as they cover each other’s weaknesses 11, 12. Our default strategy at the time of writing is based on the signals of over 100 different models, which greatly contributes to how we’ve produced market-beating results since our inception.

Thus, we continually develop and search for new signals to aid us. One signal that we’ve found particularly effective is Quiver Quantitative’s Fear and Greed Index.

Intro to Quiver Quantitative and the Fear and Greed Index

Quiver Quantitative is an alternative data provider catered to retail traders. Quiver aims to close the gap between institutional and retail traders by scraping alternative stock data from across the internet and aggregating it in a free, easy-to-use web dashboard 13. Access to more data enables retail traders to make more informed and, thus, better investment decisions. Some of Quiver’s most popular datasets cover trades made by members of Congress and company insiders.

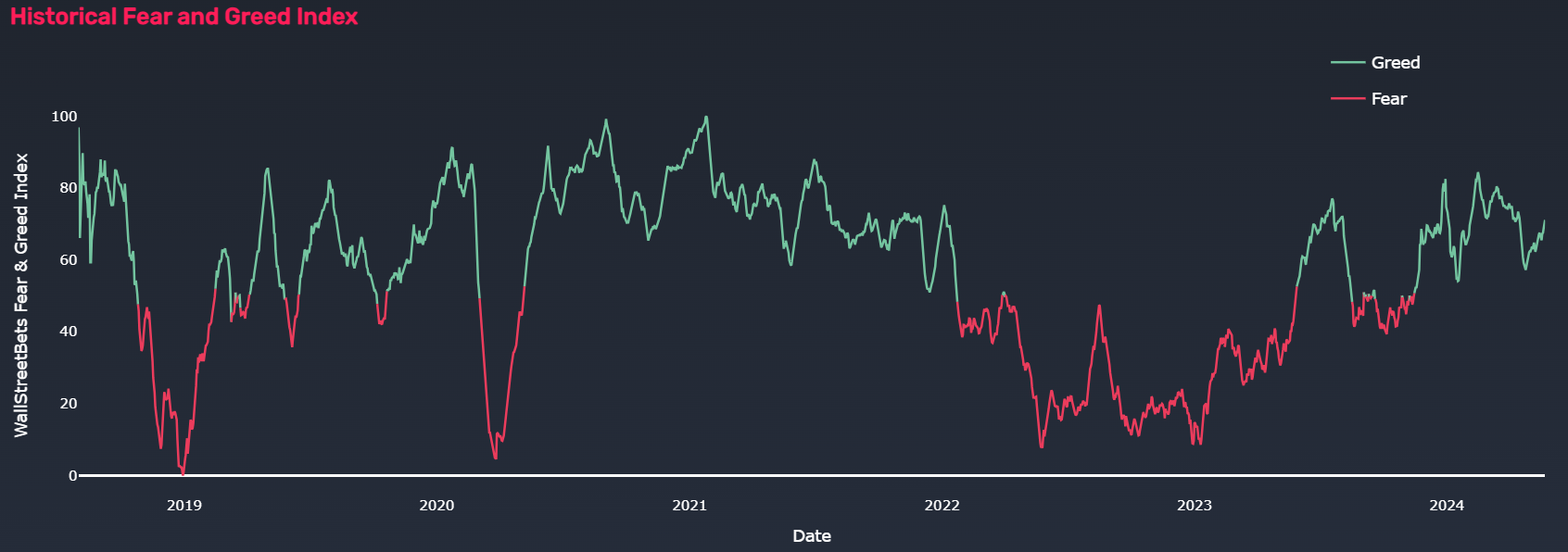

Quiver’s Fear and Greed Index (F&G) tracks the relative bullishness or bearishness of discussion on the WallStreetBets forum. WallStreetBets is one of the largest investment-related subreddits, where participants discuss stock and options trading. It became notable for playing a major role in the 2021 GameStop short squeeze that caused major losses to some institutional funds and short sellers 14. F&G is created by using natural language processing (NLP) to gauge the sentiment on the WallStreetBets forum. F&G is quantified as a number between 0 and 100, with 100 indicating the maximum level of bullishness, 0 indicating the maximum level of bearishness, and 50 being the midpoint. The data history begins in August 2018 and extends to the present. A new value is generated daily based on the previous day’s data, i.e., the data is one day lagged 15.

Source: Quiver Quantitative

Using Quiver Quantitative’s Fear and Greed Index to Manage Volatility

We hypothesize that using F&G to manage an investment strategy’s exposure level to TQQQ will yield a greater risk-adjusted return than a passive approach. Our analysis period will be from January 1, 2019, to April 29, 2024. We will compare the performance results of our risk-managed investment strategy using F&G (F&G Strategy) with a buy-and-hold approach of TQQQ (TQQQ Strategy) as well as a buy-and-hold approach of the S&P 500 (SPX Strategy).

Let’s first establish some baseline metrics. The TQQQ Strategy and the SPX Strategy yield the following results over the test time period:

As expected, the TQQQ Strategy yields a higher overall return than the SPX Strategy, but the volatility level of 66% corresponds to an unacceptable level of risk. Even more alarming is that the TQQQ Strategy experienced a 79% drawdown in 2022, rendering this strategy unfeasible for virtually all investors, regardless of their risk tolerance. For the level of risk taken, the TQQQ Strategy does not beat the SPX Strategy since the Sharpe Ratios for both strategies are the same (you can roughly think of the Sharpe Ratio as the return adjusted by the volatility).

Now, let’s describe the F&G Strategy. Our goal is to create a strategy that actively manages exposure to TQQQ in an automated and systematic way. We are targeting a portfolio volatility level of 30%, which roughly matches that of the Nasdaq-100 and is also the maximum level we are personally willing to accept as investors. To accomplish this, we propose a binary risk-on/risk-off approach that only trades TQQQ. When the value of F&G is 50 or greater (indicating relative bullishness), the strategy will be in its risk-on state, and exposure to TQQQ will be 70% of the portfolio’s value. When the value of F&G is below 50 (indicating relative bearishness), the strategy will be in its risk-off state, and exposure to TQQQ will be 20% of the portfolio’s value. The excess portfolio value will be held in cash and can be invested in a high-yielding money market or treasury fund to provide steady dividend income and further boost returns (this aspect will not be discussed in this paper).

When we run this strategy, we see a significant improvement in the investment outcome when compared to a passive approach:

Compared to the SPX Strategy, the F&G Strategy delivered greater overall returns and, more importantly, greater risk-adjusted returns, as illustrated by a Sharpe Ratio that is more than 60% better. Even more impressive is the F&G Strategy’s staggering 13.6% of alpha generated, indicating that the actions taken by our automated risk management system significantly contributed to our strategy’s outperformance over a buy-and-hold approach. Compared to the TQQQ Strategy, the volatility of the F&G Strategy was significantly lower and stayed below our target 30% range. More importantly, the drawdown in 2022 was reduced by more than half, from 79% to 34%, which is within our acceptable range. The bottom line is that using the F&G Index as a signal to manage risk resulted in a significantly better risk-adjusted return over a passive, buy-and-hold approach.

Below are some additional charts for your reference:

Source: alphaAI

Source: alphaAI

Conclusion

We conclude that using the F&G Index as a signal to manage risk resulted in a significantly better risk-adjusted return over a passive, buy-and-hold approach. Compared to the TQQQ Strategy, which was unfeasible due to its extremely high level of volatility and drawdowns, the F&G Strategy was viable and brought volatility and drawdowns into a controllable and expected range. Compared to the SPX Strategy, the F&G Strategy yielded significantly greater risk-adjusted returns and generated positive alpha.

It’s important to note that you, as an investor, will likely have a different level of risk tolerance. The parameters of the F&G Strategy, such as TQQQ exposure, can be adjusted so that volatility and drawdowns match your expectations, which is exactly what alphaAI helps you do in an automated way.

As previously discussed, as time passes, the market continues to generate data and correlations that have never been present before. This is why it’s impossible for a single signal to be effective 100% of the time. Thus, we recommend that our clients diversify their portfolios by running investment strategies based on multiple different signals. We recommend running a version of the F&G Strategy in addition to the other strategies offered by alphaAI. As of the time of writing, alphaAI’s default strategy is based on the signals of over 100 different models. Diversification of a portfolio’s strategies to multiple signals, including F&G, leads to improved investment outcomes over the long run.

If the types of investment systems described in this paper appeal to you, please consider checking out alphaAI and Quiver Quantitative. Don’t hesitate to reach out if you have any questions or feedback: support@alphaai.capital

References

- https://www.investopedia.com/terms/l/leveraged-etf.asp

- https://www.etf.com/sections/etf-basics/why-do-leveraged-etfs-decay

- https://www.proshares.com/our-etfs/leveraged-and-inverse/tqqq

- https://etfdb.com/etf/TQQQ/#etf-ticker-profile

- https://www.proshares.com/globalassets/proshares/fact-sheet/prosharesfactsheettqqq.pdf

- https://www.investopedia.com/terms/v/volatility.asp

- https://www.alphaai.capital/journal-entries/volatility-standard-deviation-why-should-you-care

- https://www.alphaai.capital/journal-entries/sharpe-ratio-risk-adjusted-returns-tell-a-different-story-than-absolute-returns

- https://www.alphaai.capital/journal-entries/alpha-the-holy-grail-of-investing

- https://www.alphaai.capital/journal-entries/our-technology

- https://www.neuravest.net/the-benefits-of-a-multi-strategy-investment-approach-2/

- https://www.investopedia.com/articles/trading/09/quant-strategies.asp

- https://www.quiverquant.com/aboutus/

- https://en.wikipedia.org/wiki/R/wallstreetbets

- https://www.quiverquant.com/fearandgreed/

The introduction of Artificial Intelligence (AI) and Machine Learning (ML) has been a game-changer in the world of finance, particularly in the realm of investment management. In this beginner's guide, we’ll explore the benefits of AI-powered investment strategies and provide practical steps to help you maximize your returns.

The Rise of AI in Investment Management

At the intersection of finance and technology, AI is playing an increasingly prominent role in automating and enhancing the decision-making process. By leveraging advanced algorithms, which continuously learn from data, AI can identify trends and insights at a scale and speed unattainable by human analysts. This allows for more precise and efficient investment strategies, leading to potentially greater returns and reduced risks.

Discovering the Benefits of Machine Learning and AI in Investment Management

One of the most significant advantages of AI in investment management is the ability to process and analyze massive datasets. We're talking decades of data and more than 10 billion data points. This encompasses not only traditional financial information but also alternative data sources such as social media sentiment, economic indicators, and geopolitical events, which can offer a more holistic view of the market.

AI’s predictive abilities are making a remarkable impact. Through ML algorithms, investment models can forecast future price movements by recognizing patterns from historical data. This can significantly improve portfolio management by informing when to buy or sell assets to optimize returns.

AI-Enhanced Investment Approaches

AI-driven investment methods are varied, spanning from quantitative trading strategies to automated wealth management services. Some of the most prevalent AI investment techniques include the following:

- Quantitative Trading: These systems utilize mathematical and statistical models to identify trading opportunities. AI enhances these models by learning from market conditions and adapting to new patterns, aiding in the development of robust trading strategies.

- Robo-Advisors: These digital platforms provide automated, algorithm-driven financial planning services with minimal human intervention. Robo-advisors are well-suited for investors seeking low-cost, passive management of their portfolios.

- Sentiment Analysis: AI tools can parse through vast amounts of news articles, social media posts, and financial reports to gauge market sentiment, which can be a powerful indicator of asset performance.

- Predictive Analytics: By forecasting future trends and market movements, AI can guide investors on when to enter or exit a position, potentially leading to more favorable investment outcomes.

Exploring Different Types of AI Investment Techniques

With the plethora of AI investment techniques available, it is vital to find the right fit for your specific investment goals and risk appetite. It's not just about the technology; it's also about aligning with your personal investment philosophy. Some investors might be drawn to the high-frequency trading capabilities of certain AI systems, while others may prefer the more measured approach of robo-advisors.

Tips for Getting Started with AI Investment Apps

1. Research Different Apps: Begin by exploring the numerous AI investment apps on the market. Look at user reviews, investment performance history, fees, and the available asset classes. Make a checklist of your investment goals and compare them against what these platforms offer.

2. Understand Their Methodologies: Different apps use various algorithms and investment philosophies. Study how these apps analyze data and make investment decisions, ensuring their strategies align with your comfort level and expectations.

3. Start Small: Venturing into AI-assisted investing doesn’t mean overhauling your entire investment strategy overnight. Instead, allocate a small part of your portfolio to these new tools. This helps you manage risk while gaining firsthand experience with AI investment strategies.

4. Monitor Performance Regularly: Keep a close eye on the AI system's performance and how it responds to different market conditions. Regularly review your investment results relative to market benchmarks to gauge the system's effectiveness.

5. Keep Learning: AI and ML are rapidly evolving fields. Stay educated on technological advancements and how they might impact investment strategies. This will help you to adapt and refine your approach over time.

Embracing AI with Caution

While AI offers remarkable potential, it’s not without risks. Investment decisions should not be based solely on algorithmic predictions. Market conditions can change swiftly, and as powerful as AI is, it can still be susceptible to unpredictable events and anomalies.

Therefore, it's crucial to combine the insights from AI with sound financial knowledge and a strong understanding of your personal investment goals. Additionally, regulatory changes surrounding AI's use in investment strategies must be closely followed to stay compliant and secure.

The Future of AI-powered Investments

AI is not just a passing trend in the investment world. It's expected to become even more integrated into various financial services, offering advanced personalization and potentially democratizing access to sophisticated investment strategies for a broader audience.

Conclusion

AI-powered investment strategies represent a compelling evolution in the financial sector, offering investors sophisticated tools to potentially enhance returns. By combining the analytical power of AI with an understanding of its capabilities and limitations, investors are well-positioned to navigate the complex financial markets of tomorrow. With prudence, continuous learning, and an openness to adapting strategies as the technology evolves, anyone can now wield the power of AI to make more informed investment decisions.

In the intricate world of investing, where myriad factors contribute to the success or failure of financial strategies, artificial intelligence (AI) has emerged as a game-changer. As we embark on the path of technological advancement, AI's superiority in various domains has become clear, and investment management is no exception. The fusion of AI and investing not only heralds a new era but also promises a level of precision and efficiency previously unattainable with human capabilities alone.

The Landscape of Traditional Investment Management

To contextualize the evolution towards AI investment management, one must first understand traditional investment practices. Investment managers conduct tireless research, analyze market trends, and use their judgment to make decisions. While successful in many cases, human managers are constrained by their limited processing capability, the inevitability of emotional bias, and the finite volume of data they can assess.

The AI Advantage

AI redefines investing by incorporating vast volumes of data to deliver insights at unprecedented speeds and with exceptional accuracy. This data processing capability extends beyond traditional market data to include news feeds, social media sentiment, and other unconventional predictors that can influence market movements. Automated systems tirelessly monitor global markets, adapting strategies in response to real-time changes, something unattainable by human traders who are bound by the necessity of sleep and understandably slower reaction times.

Access and Empowerment

One advantage of AI investment systems is their democratizing effect on financial markets. By lowering minimum investment amounts and fees, AI investment platforms have broken down barriers, enabling investors with limited capital to participate. This inclusivity has escalated the evolutionary pace of investing, encouraging novice traders to invest with the assistance of advanced AI algorithms.

A New Threshold of Security and Performance

Traditionally, human error has been a significant point of vulnerability in financial markets. AI systems, being devoid of emotional decision-making, impart a higher degree of consistency and dependability. By following pre-established algorithms, AI avoids the pitfalls of panic selling in declining markets or over-enthusiasm in booming ones—common emotional traps for human investors.

The implementation of AI in investment management has also seen an increase in security measures. With advanced encryption and continuous monitoring for anomalous transactions, AI systems are designed to offer superior protection against hacking and other cybersecurity threats.

The Balancing Act – Understanding the Risks

Acknowledging the potential risks associated with AI investment management is essential. No system is infallible, and AI is no exception. Algorithmic failures, albeit rare, can occur, causing significant repercussions. Moreover, the increasing number of AI systems operating in today's financial markets raises the specter of AI entities trading in a loop, sometimes referred to as "AI trading against itself," which can lead to unpredictable market fluctuations.

Overcoming Potential Pitfalls

Though these risks present a challenge, they are not insurmountable. At alphaAI, sophisticated measures are in place to mitigate such vulnerabilities, with continual algorithmic refinement and oversight to ensure stability and security.

alphaAI's commitment to cybersecurity is paramount. We employ state-of-the-art protocols to guard against breaches, ensuring that our clients' investments and personal information are secure. Our vigilance in monitoring for potential threats is relentless, providing peace of mind that the AI platforms guiding your investments are as robust as they are revolutionary.

Make the Leap with alphaAI Today

Standing on the cusp of this financial revolution, the question is not whether AI will continue to transform investment management, but how swiftly and comprehensively investors will adopt these innovations. As an investor ready to harness the potential of AI, your next move is pivotal.

alphaAI is here to facilitate that transition. Our commitment to innovation, security, and client empowerment positions us at the forefront of AI investment management. Join alphaAI today, and harness the remarkable power of AI-enhanced investment strategies.

The financial landscape is undergoing a pivotal transformation as the prowess of artificial intelligence (AI) seeps into investment management. With AI, a dawn of data-driven, automated, and highly efficient investment strategies is upon us, promising to redefine how we understand, approach, and interact with the markets. But as with any technological advancement, AI's advent in investment management comes with its share of trepidation, skepticism, and myths that need addressing. Let's dive into the fears surrounding AI and debunk the myths that often deter investors from embracing this technological marvel.

Myth 1: The Impersonal Nature of AI Systems

Many investors fear that AI investment management equates to a depersonalized experience. However, AI systems are increasingly sophisticated, capable of analyzing individual investor preferences and customizing investment strategies accordingly. AI does not mean a one-size-fits-all strategy; it represents a new era of personalized investment management at scale.

Myth 2: AI Managers Will Replace Humans Completely

The haunting question in the corridors of financial institutions is whether AI will take over human tasks completely, rendering investment experts obsolete. It's a daunting prospect, but one rooted more in science fiction than in reality. While AI brings an unmatched ability to churn through and make sense of complex datasets, human intuition, emotional intelligence, and creative problem-solving remain irreplaceable. The more likely scenario is a collaborative one, where AI enhances human potential by taking over repetitive, data-intensive tasks, thereby freeing up human experts to focus on more strategic, value-adding activities.

Myth 3: AI Systems Are Too Complex to Understand

AI, with its intricate algorithms and machine learning models, may appear impenetrable to the uninitiated. This complexity breeds fear of a 'black-box' scenario, where decisions are opaque and beyond our comprehension. However, advancements in explainable AI (XAI) are bridging the gap, providing transparency into AI’s decision-making process. Clear explanations of AI's inner workings are becoming more commonplace, giving investors confidence not just in the outcomes but in the journey that leads there.

Myth 4: AI Systems Always Outperform Traditional Methods

The belief that AI is infallible and always beats traditional investment strategies overestimates its capabilities. While AI excels at parsing data points and predicting trends with a degree of accuracy unattainable by humans alone, it’s not free from limitations. Algorithmic biases, data quality issues, and unforeseen market catastrophes can trip AI systems. They do not possess the innate human capacity to sense the subtleties of geopolitical tensions, regulatory changes, or cultural shifts that might impact markets. Thus, AI should be seen as a potent tool in the investor's arsenal, not a magic bullet.

While AI isn't perfect, it often beats old-school ways of investing. It can spot trends and make quick choices that humans might miss, leading to better profits over time.

Discovering the Benefits of AI Investment Platforms

Having dispelled some of the myths, one can now appreciate the myriad benefits of utilizing AI in investment management. AI-powered platforms are revolutionizing the investing experience, making it more efficient and, in many instances, more rewarding.

The speed and depth of data analysis that AI systems offer are unparalleled. They can sift through decades of market data, global news, and financial statements in the blink of an eye, finding correlations and insights that would take a human analyst an impossible amount of time. This rapid analysis leads to the swift identification of potential investment opportunities, sometimes even before they become evident to the market at large.

Moreover, AI systems can execute trades with precision and without the psychological biases that typically afflict human traders. By automating certain trading decisions, AI reduces the probability of costly impulsive or emotional decisions. This automation also extends to rebalancing portfolios, managing the diversification of assets to maintain a targeted risk profile.

The continuous learning aspect of AI is also groundbreaking. Unlike traditional methods, where updating strategies might require cumbersome research and committee approval, AI systems can adapt their strategies in real-time. This responsiveness to market dynamics is critical in the fast-paced world of investing.

Lastly, the scalable nature of AI means that it can democratize high-quality investment management, traditionally the domain of wealthy individuals and institutions. AI platforms can provide top-tier investment strategies to a much broader audience at a fraction of the cost of traditional investment managers. This cost efficiency allows for greater accessibility and can lead to higher net investment returns for individuals across the economic spectrum.

Join the alphaAI Community

Recognizing the potential surrounding AI in investment management, alphaAI has crafted a platform that marries the expertise of seasoned investment professionals with cutting-edge AI technology.

At alphaAI, we’re passionate about fostering a community of forward-thinking investors who not only recognize the power of AI but who are also eager to participate in its evolution within the investment realm. By joining alphaAI, you become part of a forefront that's shaping the future of investment management.

Investing has always been a popular means towards building wealth, and with advances in technology, AI-powered investment platforms are transforming the world of investment by automating key processes and providing intelligent insights. For someone looking to venture into the landscape of AI investing, it's crucial to find a platform that aligns with your investment strategy and goals.

Understanding AI in Investment

Before diving into the criteria for selecting an AI investment platform, it's essential to understand what AI investing entails. AI investment platforms use algorithms and machine learning to analyze huge amounts of data, recognize patterns, predict market trends, and make automated decisions on behalf of investors. The integration of AI in investment strategies can help in reducing human error, managing risks, and increasing the efficiency and profitability of investments.

Core Considerations for Selecting an AI Investment Platform

When starting the search for the best AI investment platform for your investment strategy, here are some factors to keep in mind:

Security Measures

In the digital age, security is paramount. With the rise of cyber threats, it's imperative to choose an AI investment platform that prioritizes the safety of your funds and personal information. A secure AI platform should offer features such as data encryption, two-factor authentication, fraud detection systems, and regular security audits. You should also ensure that the platform has a robust backup system to protect your data in case of a breach or technical failure.

Automated Trading Feature

One of the biggest advantages of an AI investment platform is its ability to perform automated trading. This feature enables the system to execute trades at the best possible times based on its analysis and predictions, without the need for you to constantly monitor the market. It can react faster than a human, taking advantage of market opportunities as they arise. But automation should be adjustable to fit your comfort level with risk and the control you want to maintain over your investment choices.

Diversity of Investment Instruments

A worthwhile AI investment platform should cater to a broad range of financial instruments, including stocks, bonds, ETFs, and cryptocurrencies. This diversity gives you the flexibility to construct a diversified portfolio that can adapt to different economic conditions. It should also provide the option for you to select from various investment strategies, whether you prefer long-term growth, value investing, or a focus on generating income.

Reputation and Track Record

Trust is crucial in the investment world. Look for platforms with a strong reputation in the market, ones that have been recognized for their performance and service quality. Check for reviews, testimonials, and track records that speak to the platform's stability and reliability. Moreover, platforms that provide transparent communication of their investment process and performance metrics should be given preference, as they demonstrate accountability and trustworthiness.

User Experience and Support

An ideal AI platform should have an intuitive and user-friendly interface, making investment management accessible even to those with minimal experience. Customer support is equally important. A platform that offers responsive and knowledgeable support can greatly enhance your investing experience, providing assistance when needed and updating you on the platform’s new features and investment opportunities.

Pricing

Consider the pricing structure of the AI investment platform. Look for transparency in fees, including any subscription costs, transaction fees, or management fees. Ensure that the pricing aligns with the value and services provided by the platform. Additionally, check if there are any hidden costs or additional charges that may impact your overall returns.

Which AI Investment Platform Should I Choose?

The market offers several AI investment platforms, each with unique features. Betterment, for instance, uses AI to provide personalized, goal-based investment advice and has a suite of tools for retirement planning. Wealthfront, another industry leader, is praised for its automated investment strategies and tax-loss harvesting features. Vanguard's Robo Advisory service is backed by one of the most reputable names in the industry and leverages AI to offer a customizable and low-cost investment solution. alphaAI stands out for its real-time monitoring capabilities and risk management tools that help investors make informed decisions.

Practical Steps to Get Started

1. Define Your Goals: Determine what you hope to achieve with your investments. This could range from saving for retirement, generating passive income, or simply growing your wealth over time.

2. Do Your Research: Compare various AI investment platforms based on the criteria mentioned. Look for independent reviews and case studies which showcase real-world performance.

3. Consider Costs:Understand the fee structure of each platform. While some may charge a management fee, others could include performance-based fees or have hidden costs.

4. Test the Waters: Many platforms offer a demo or trial period. Use this to familiarize yourself with the platform's interface and features.

5. Start Small: Begin with a modest investment to observe how the platform performs and fits your comfort level before fully committing your funds.

Final Thoughts

The advent of AI investment platforms offers individual investors an unprecedented opportunity to benefit from advanced trading algorithms and data analytics. It's no longer merely the domain of institutional investors. By considering the criteria above, you can select an AI investment platform that not only aligns with your investment goals but also offers a secure, flexible, and user-friendly investing experience. Take that step towards smarter investing and optimize your financial potential with alphaAI.

Frequently Asked Questions

Find answers to common questions about alphaAI.

How does alphaAI Capital work?

At alphaAI Capital, every strategy has four modes: Surge, Steady, Cautious, and Defense. Our Investment AI will automatically switch between modes based on market conditions.

The idea is simple: When the market looks good, we invest more to help you earn more. When the market seems risky, we invest less to help protect your money.

How does alphaAI Capital use AI?

We use AI to automate the entire investment process, from beginning to end.

At the core of our industry-leading AI system is a team of predictive machine learning models. These models are trained on decades of data from more than 10,000 global stocks, analyzing over 10 billion data points on average. Each model is built for a specific purpose, and together they work as a team to make smarter trading decisions.

Our portfolio management system then takes these predictions and uses a clear, rules-based process to decide how to act. This includes making trades and managing risk, all tailored to your unique investor profile. Plus, we’ve built in multiple safety measures to ensure that every decision stays within strict, pre-defined limits.

Is it safe to let AI handle my money?

Yes, absolutely. There’s no chance our AI will take unexpected actions – and here’s why.

At its core, AI is simply machine learning (ML), which is a branch of math that uses models to find and learn from patterns in data. We use these predictive models alongside a clear, rules-based system to make trades and manage risk, all tailored to your unique investor profile. To add an extra layer of protection, we’ve built in multiple safety protocols to ensure every action stays within strict guidelines.

So, there’s no need to worry – AI isn’t sentient, and it can’t make its own decisions. It’s just a tool we use to process data and generate smart, reliable investment strategies.

What is the minimum account size?

Get started with as little as $100.

How is alphaAI Capital different from other roboadvisors?

alphaAI Capital is the only roboadvisor that adjusts your portfolio to the markets in real-time. Other roboadvisors use a purely passive investment approach, which leaves you unable to take advantage of market trends.

At alphaAI Capital, we use responsive investment strategies to manage your risk. The idea is simple: When the market looks good, we invest more to help you earn more. When the market seems risky, we invest less to help protect your money.

What is alphaAI Capital's investment philosophy? How do you control risk and drawdowns?

Our goal is simple: deliver better risk-adjusted returns than the market.

Our AI system adjusts your strategy to your unique investor profile and risk tolerance. We adapt your portfolio’s risk level to the markets in real time, helping keep your portfolio’s volatility and drawdowns within your defined acceptable range.

How hands-on or off is alphaAI Capital?

alphaAI Capital is completely hands-off – set it and forget it.

All you have to do is set your investor profile and customize your strategies. After that, we take care of everything for you. However, we aren't your regular stock trading bot. In fact, we wouldn't classify ourselves as a "bot" at all because we automatically make trades and manage your portfolio’s risk in response to market conditions. Our leading-edge AI system stays on top of the market so you don’t have to. Rest easy knowing that regardless of what the market does, we are responding in the best way for you and your financial goals.

What assets can I invest in through alphaAI Capital?

Our strategies are optimized for ETFs, including leveraged and inverse ETFs. We will be adding additional asset classes in the future.

Learn more about ETFs and how they could help you achieve your investment goals.

Discover the power of alphaAI.

Unlock the potential of AI-driven portfolio management.